owe state taxes california

Ad Use our tax forgiveness calculator to estimate potential relief available. There are also states that apply no income tax but they still have ways to collect money.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

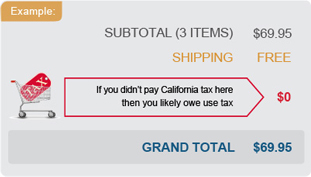

. If YOU did not pay the state tax due and have bankcredit card records to prove it then you still owe. Free Confidential Consult. Free Confidential Consult.

073 average effective rate. 2 Why do I have to pay taxes on my tax refund. Ad See if you ACTUALLY Can Settle for Less.

The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code. Filing a late tax return is one of the most common reasons that a large number of taxpayers owe money to the FTB. There is a 10 penalty for not filing your return andor paying your full tax or fee payment on time.

4 Is Tax Return considered. 3 Why do I owe state taxes but not federal. What is California income tax rate 2020.

California State Tax Quick Facts. Why do I owe so much state tax California. Affordable Reliable Services.

What is California state tax rate. The state tax rate the local tax rate and any district tax rate that may be in effect. We can Help Suspend Collections Wage Garnishments Liens Levies and more.

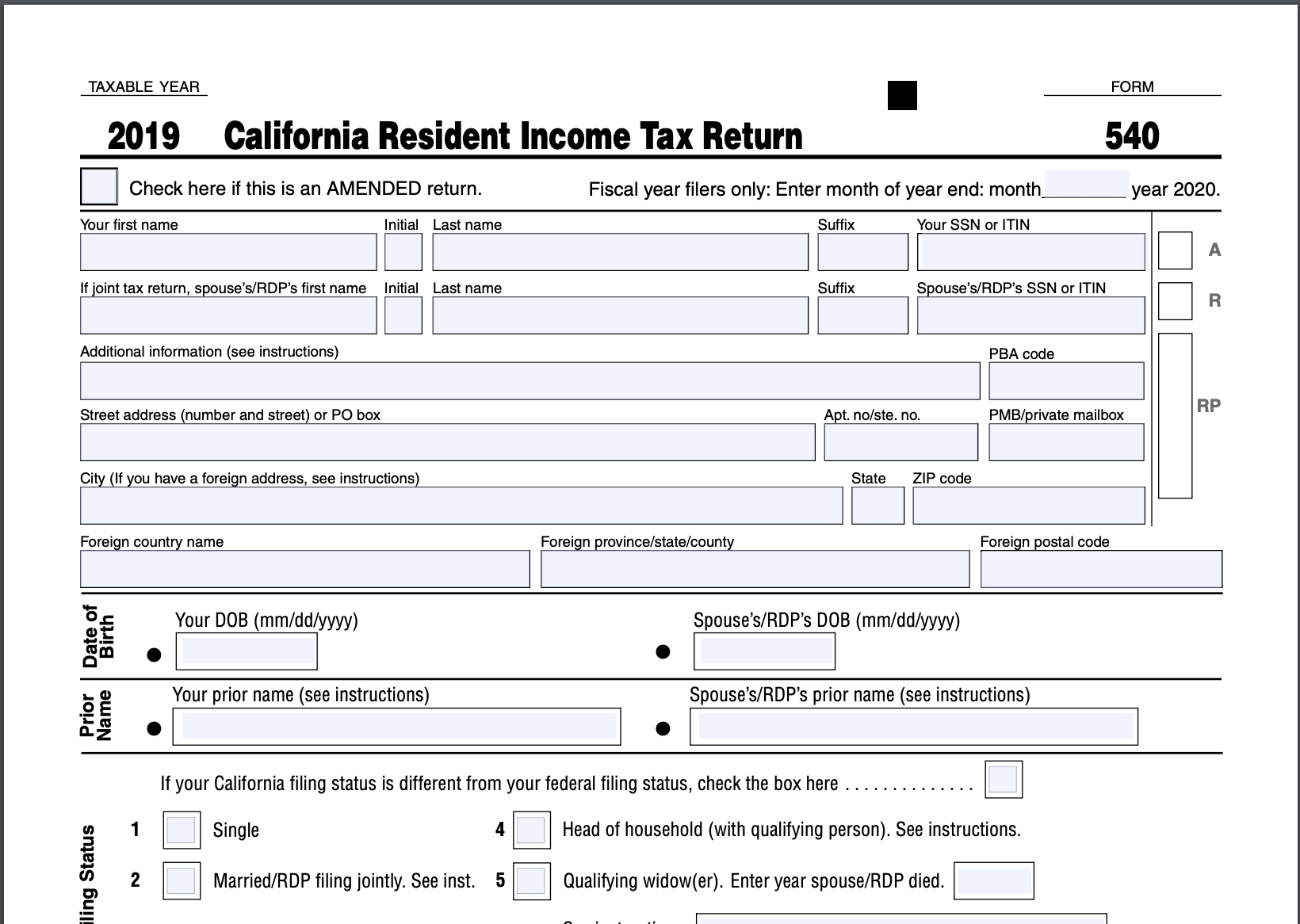

5110 cents per gallon of regular. California state tax rates are 1 2 4 6 8 93 103 113 and 123. The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code.

Federal tax brackets go from 10 for incomes between 10000 and 19999 to 37 for those earning more than 523600. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Those who dont pay their state income taxes contribute to Californias tax gap the difference between taxes owed and taxes paid.

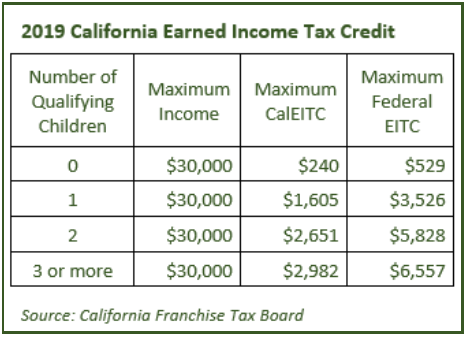

Trusted Tax Co 35 Years. Ad Use our tax forgiveness calculator to estimate potential relief available. If you qualify for the California Earned Income Tax Credit EITC 7.

Every effort has been made to offer the most correct. California state tax rates and tax brackets. If you had money.

You can get up to 3027. In California the lowest tax bracket is. Your corporation will not owe.

There are 43 states that collect. 1 Is California state tax refund taxable. Paying taxes owed to the state of California can be completed either online in person by mail or by telephone.

Affordable Reliable Services. Taxes are not the same in each state they are calculated differently. Take Advantage of Fresh Start Options.

California corporations with taxable income are subject to the states corporate income tax and potentially the states alternative minimum tax. Ad See if you ACTUALLY Can Settle for Less. Specifically a taxpayer can.

Take Advantage of Fresh Start Options. Sometimes people dont pay their taxes. The sales and use tax rate in a specific California location has three parts.

A 1 mental health services tax applies to income exceeding 1 million. What happens if you owe California state taxes. If you do not owe taxes or have to file you may be able to get a refund.

Both personal and business taxes are paid to the state.

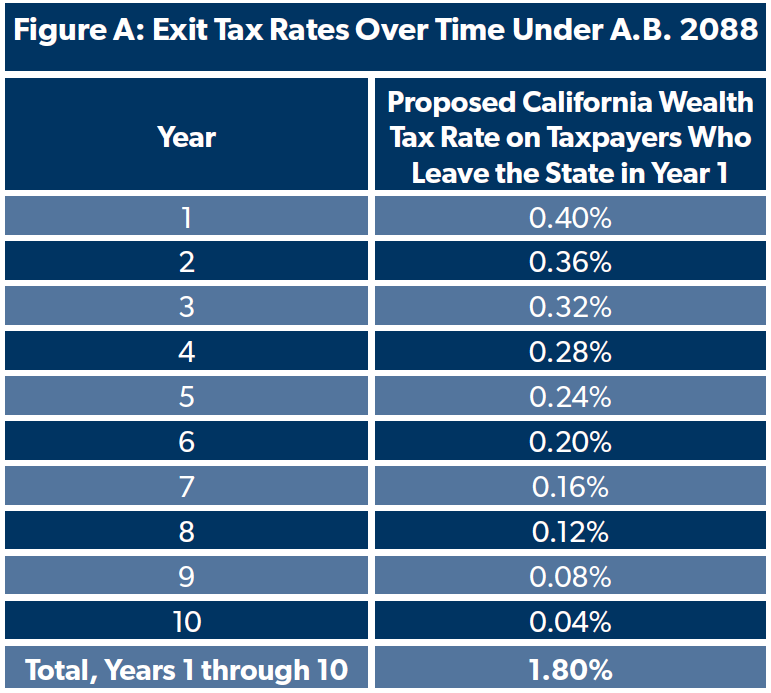

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

Picture Of California Tax Refund Iou Registered Warrant My Money Blog

Federal And State Tax Payment Deadlines Extended To July 15 The Santa Barbara Independent

I Owe California Ca State Taxes And Can T Pay What Do I Do

What Are The State Income Tax Rates For California Quora